Meanwhile, the bottom performing sectors all had total returns greater than 10%, made up of retail (+10.7%), self storage (+13.7%), lodging/resorts (+15.7%), and health care (+21.2%). It should further be noted that three of these four sectors have strong ties to e-commerce and the technology sector. The MSCI ACWI consists of 49 country indices comprising 23 developed and 26 emerging market country indices. While these larger companies performed strongly, the unweighted average total returns shown in the table below reflect strong performance across all cap groups. The MSCI All Country World Index (ACWI) is a free-float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. One characteristic these property sectors have in common is that the bulk of the sector market value is concentrated among a small group of companies. While that did fall a bit short of the S&P 500 Index's 32 total return, it was an excellent year for the REIT sector. REITs delivered well above average performance in 2019, as the sector generated a 28.7 total return. Its main function is to ensure that global trade. Four sectors had total returns greater than 40%, led by industrial (+48.7%), data centers (+44.2%), timberland (+42.0%), and infrastructure (+41.9%). For comparison's sake, the S&P 500 Index generated an average annual total return of 7.3 during that time frame. Global trade - The World Trade Organization (WTO) deals with the global rules of trade between nations.

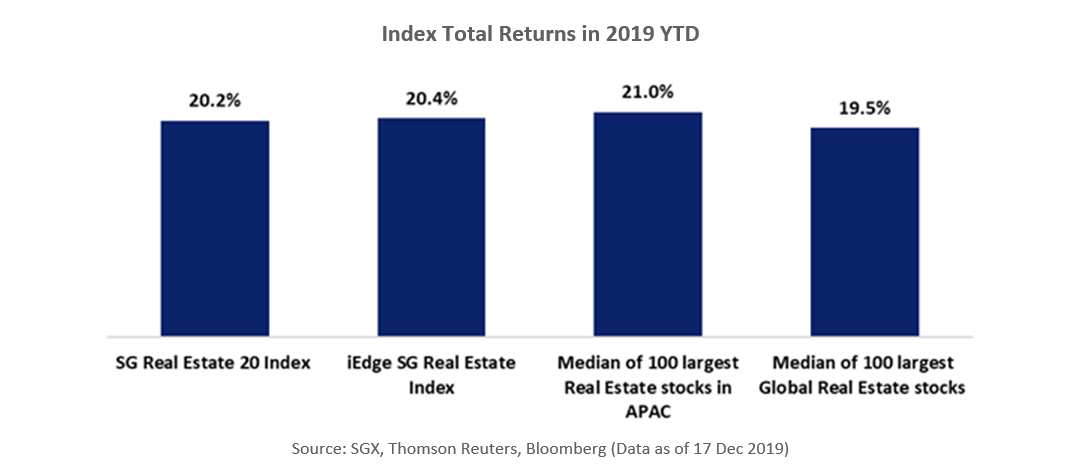

2019 index returns series#

Real Estate Index Series posted positive total return performance across all property sectors in 2019. A problem with talking about average investment returns is that there is real.

0 kommentar(er)

0 kommentar(er)